WLFI Price Analysis Reveals Hidden Catalyst for New Highs

WLFI (World Liberty Finance) officially launched on spot exchanges yesterday, and traders didn’t waste time testing its limits. After surging to an early all-time high near $0.35 on Spot exchanges, the token has since corrected sharply, losing more than 19% in the past 24 hours.

While parts of the market look bearish, a deeper look reveals one unlikely momentum driver that could push WLFI beyond its recent high.

Spot Market Shows Early Weakness

On-chain flows over the past 24 hours highlight why the spot market looks fragile for WLFI.

Top 100 addresses offloaded almost 216.54 million WLFI, worth close to $49.15 million at the average price of 0.227. Smart Money did pick up more than 102.78 million WLFI during the same period, almost $23.33 million in value. Public Figures, which include known KOLs and prominent market personalities, dumped close to $546.40 million.

Whales holding between one and ten million tokens added 26.85 million WLFI, worth close to $6.10 million. While this accumulation looks large in percentage terms, it is inconsequential when compared to the scale of outflows from the Top 100 addresses and Public Figures.

Taken together, the spot market shows clear early weakness, with net selling pressure dominating. This makes it unlikely that buyers on the spot alone can drive WLFI higher in the near term. Instead, attention turns to the derivatives market, where liquidation maps and positioning hint at a very different story.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Derivatives Positioning Signals a Potential Trigger

If spot demand falters, derivatives often step in as the first unlikely short-term catalyst. WLFI’s perpetual contracts have been live since August 23, even before spot trading. That makes the derivative charts especially useful for early signals.

Across Binance, Bitget, and Hyperliquid, the picture is strikingly similar: short positions dominate. On Binance alone, shorts account for nearly double the long liquidations. At Bitget, short liquidations sit above $23 million, compared with just $16.6 million for longs. Hyperliquid’s seven-day liquidation map shows clusters near $0.28, a critical threshold.

This imbalance creates the conditions for a short squeeze — when rising prices force shorts to cover, accelerating the rally. If WLFI clears $0.28, those clusters could unwind quickly, potentially propelling the token toward $0.32, its previous swing high.

It is worth noting that if the WLFI price corrects, the token also becomes a long squeeze candidate, which would then invalidate the near-term bullish outlook. More about this in the price analysis segment.

WLFI Price Action and the Hidden Bullish Divergence

The perpetual chart offers important context for WLFI price. Between 27 and 29 August, the token showed a short-term setup where the WLFI price made a higher low while RSI printed a lower low. That divergence helped fuel the late-August rally.

Now, zooming out, a broader version of the same pattern has emerged. From August 24 to September 1, the WLFI price again formed higher lows, while RSI extended to fresh lower lows. This kind of divergence across a wider timeframe often signals that downside momentum is weakening despite the spot market, creating room for another upside attempt.

WLFI’s perpetual contracts went live on August 23, 2025, ahead of the token’s spot listings across exchanges. At launch, they operated under a capped price mechanism, meaning trading was constrained within a set range until an official spot index became available.

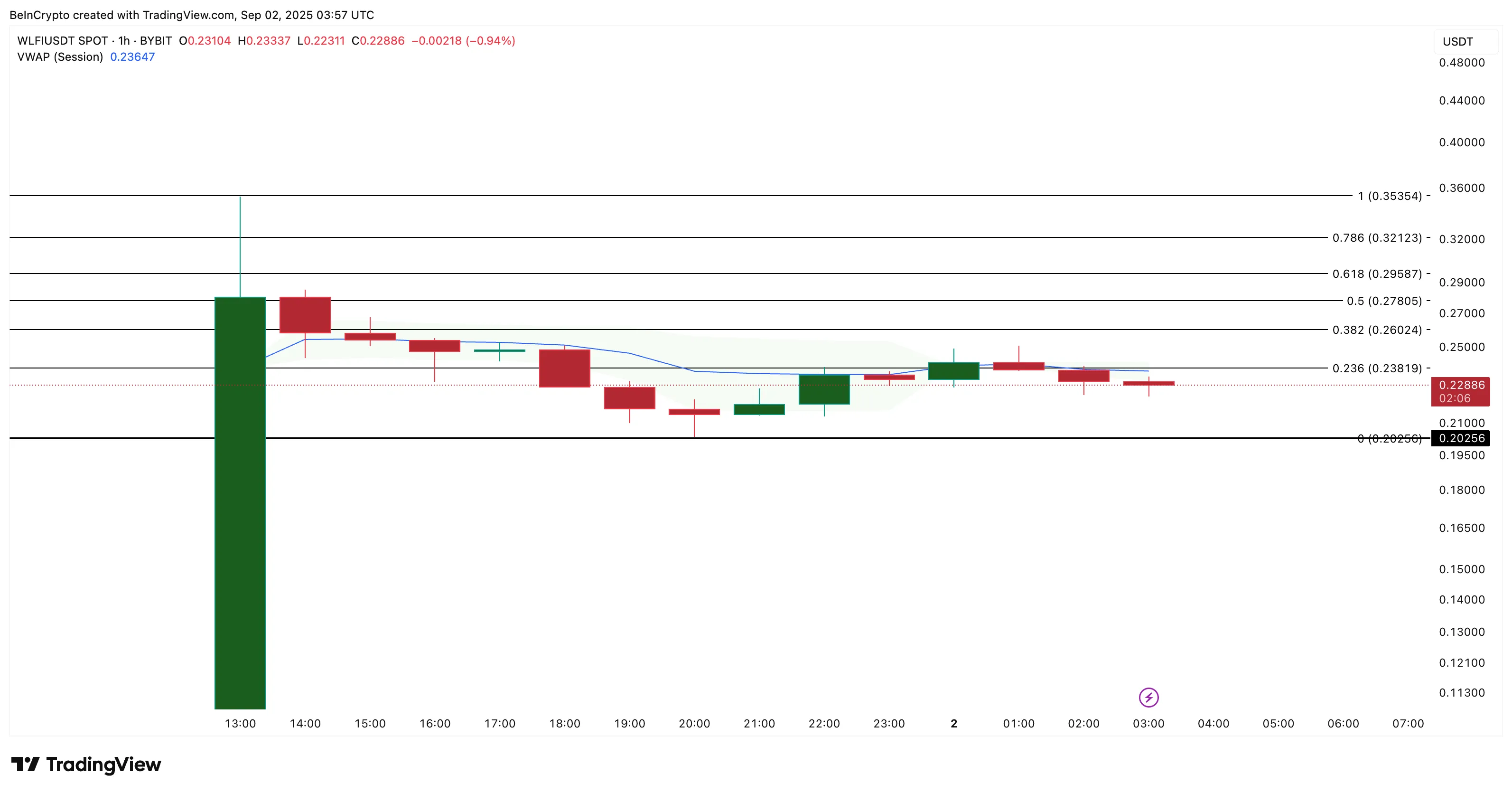

On the Bybit spot chart (1-hour), WLFI trades just under the VWAP (Volume-Weighted Average Price) line near $0.23. VWAP tracks the average price weighted by volume and is often treated by traders as dynamic support or resistance. WLFI has already attempted to cross VWAP but failed, making it a near-term hurdle.

A decisive move above $0.23 would align technical momentum with derivatives positioning.

If that alignment holds, the domino effect is clear: breaching $0.29 could liquidate shorts, $0.32 would retest the high, and beyond that, the WLFI price would enter price discovery, opening the door to a new all-time high.

However, a dip under $0.20 would bring in long liquidations in play, defeating the near-term bullish outlook and pushing the price into the untested downside territory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.