3 Reasons Why Bitcoin’s Early 2026 Recovery Could End Soon

Bitcoin’s (BTC) recovery in early 2026 may not last long, as new data points to mounting potential selling pressure. Traders holding Long positions may need to consider opposing conditions to minimize risk.

On-chain data shows Bitcoin whales are increasing their activity on exchanges. This behavior is especially risky in a low-volume environment.

Sponsored

Sponsored

Bitcoin Whale Inflow Ratio Spikes in January

One of the most alarming signals is the All Exchanges Whale Ratio (EMA14), which has climbed to its highest level in ten months.

This metric represents the ratio of the top 10 inflows to total exchange inflows. High values indicate that whales are using exchanges heavily.

Although Bitcoin exchange reserves continue to trend downward due to demand from DATs and ETFs, the sudden surge in this ratio may serve as an early warning. It suggests that BTC balances on exchanges could start rising again.

“This development coincides with Bitcoin’s price attempting a recovery after a corrective phase. The pattern suggests a potential strategy by whales to capitalize on buy-side liquidity to take profits and use the current market as exit liquidity,” CryptoOnchain, an analyst at CryptoQuant, commented.

Furthermore, increasingly fragile market liquidity heightens the risk of sharp price swings and heightened volatility.

Sponsored

Sponsored

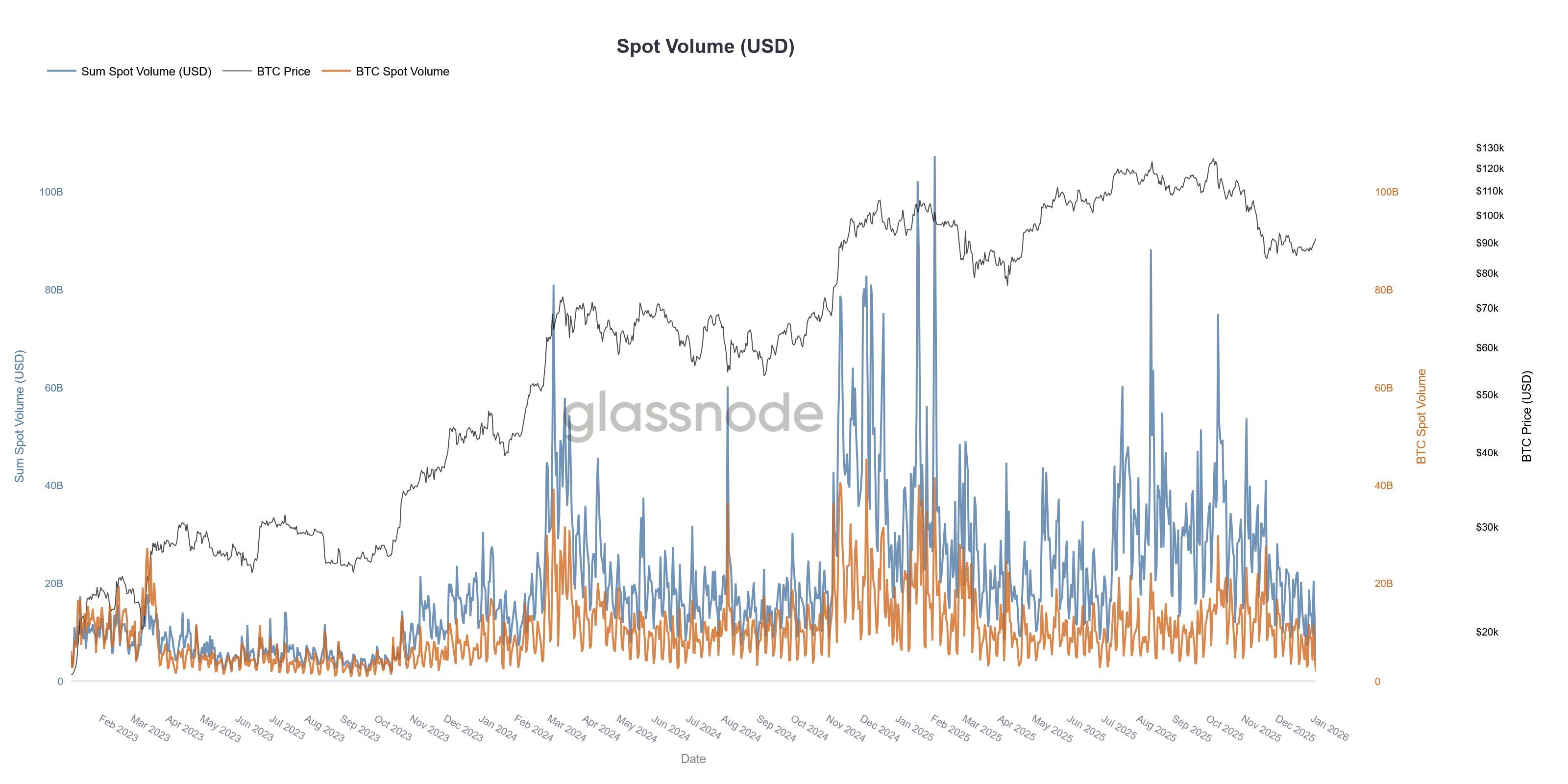

According to a post by Glassnode on X, spot trading volume for Bitcoin and altcoins has fallen to its lowest level since November 2023.

“This weakening demand contrasts sharply with upside moves across the market. It highlights increasingly thin liquidity conditions behind recent price strength,” Glassnode reported.

In a low-liquidity environment, only limited buying pressure is needed to push prices higher. Conversely, moderate selling pressure can easily trigger large downside moves.

If whales on exchanges begin selling as suggested, combined with thin liquidity, Bitcoin’s more than 6% rebound and the 10% recovery in total altcoin market capitalization could soon come to an end.

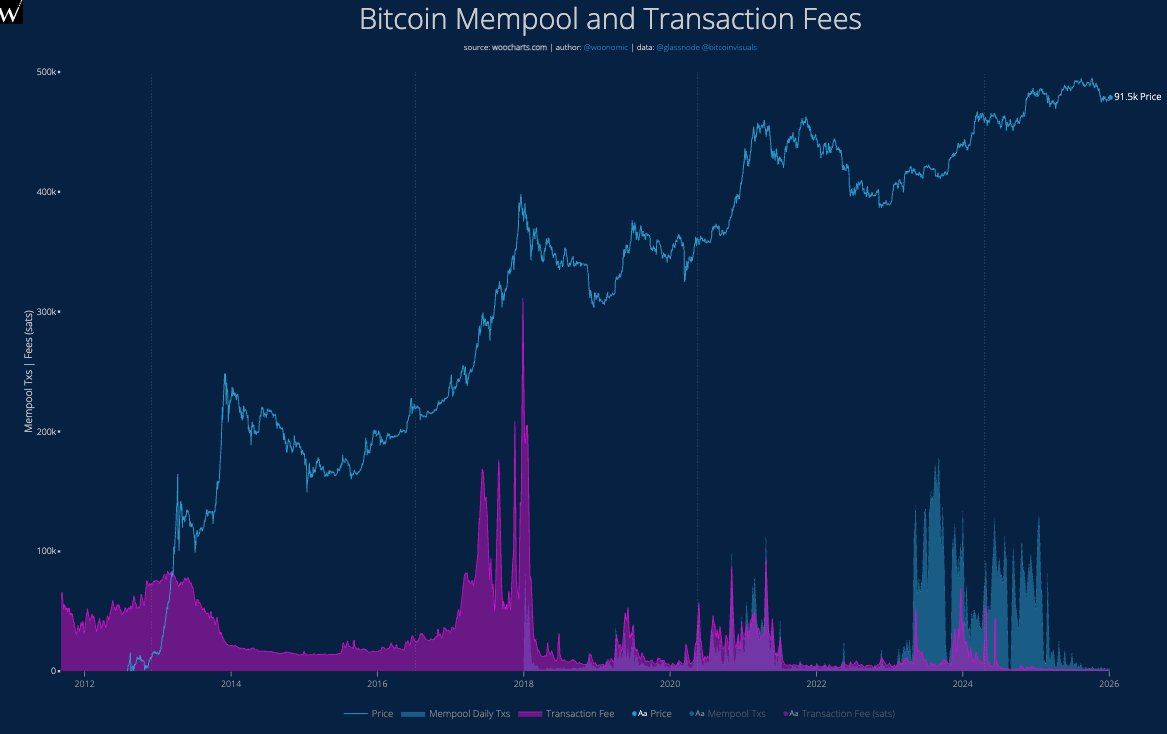

Furthermore, analyst Willy Woo noted a sharp decline in Bitcoin transaction fees, describing the market as a “ghost town.”

Charts tracking the mempool and transaction fees show on-chain activity at record lows. Both indicators have dropped sharply, reflecting a decline in transactions. Reduced on-chain activity implies weaker capital inflows and outflows, making the market less dynamic.

Woo expects a potential short-term pump in January as liquidity hits a local bottom. However, the longer-term outlook remains bearish due to the lack of real activity.

In the short term, some analysts expect Bitcoin to correct toward the $90,000 and $88,500 zones. These levels also align with a newly formed CME gap.