XRP Hits $130 Billion Market Cap as Bullish Momentum Grows

XRP is gaining momentum once again, climbing nearly 6% in the past week and pushing its market cap back above $130 billion for the first time since March 27.

The altcoin’s RSI has entered overbought territory for the first time in over a month, its Ichimoku Cloud setup remains bullish, and its EMA lines have formed consecutive golden crosses. With traders eyeing both breakout targets and key support zones, XRP enters a pivotal moment that could define its next major move.

XRP Enters Overbought Zone for First Time Since March

XRP’s Relative Strength Index (RSI) has surged to 76.19, climbing above the 70 threshold for the first time since March 19 — over a month ago.

Just yesterday, its RSI was at 51.4, signaling a sharp increase in buying momentum within a short period.

This jump suggests that XRP is entering an overbought zone, a level where price action often begins to slow or reverse, depending on broader market sentiment.

RSI is a momentum indicator that ranges from 0 to 100 and helps traders assess whether an asset is overbought or oversold. A reading above 70 typically signals overbought conditions, suggesting that the asset may be due for a pullback.

A reading below 30, on the other hand, signals oversold conditions and potential for a bounce. With XRP now at 76.19, traders may begin to watch for signs of weakening momentum or consolidation. Despite that, some analysts claim XRP market cap could soon surpass Ethereum’s.

However, strong upward RSI moves can also signal the start of a breakout if supported by volume and broader bullish sentiment.

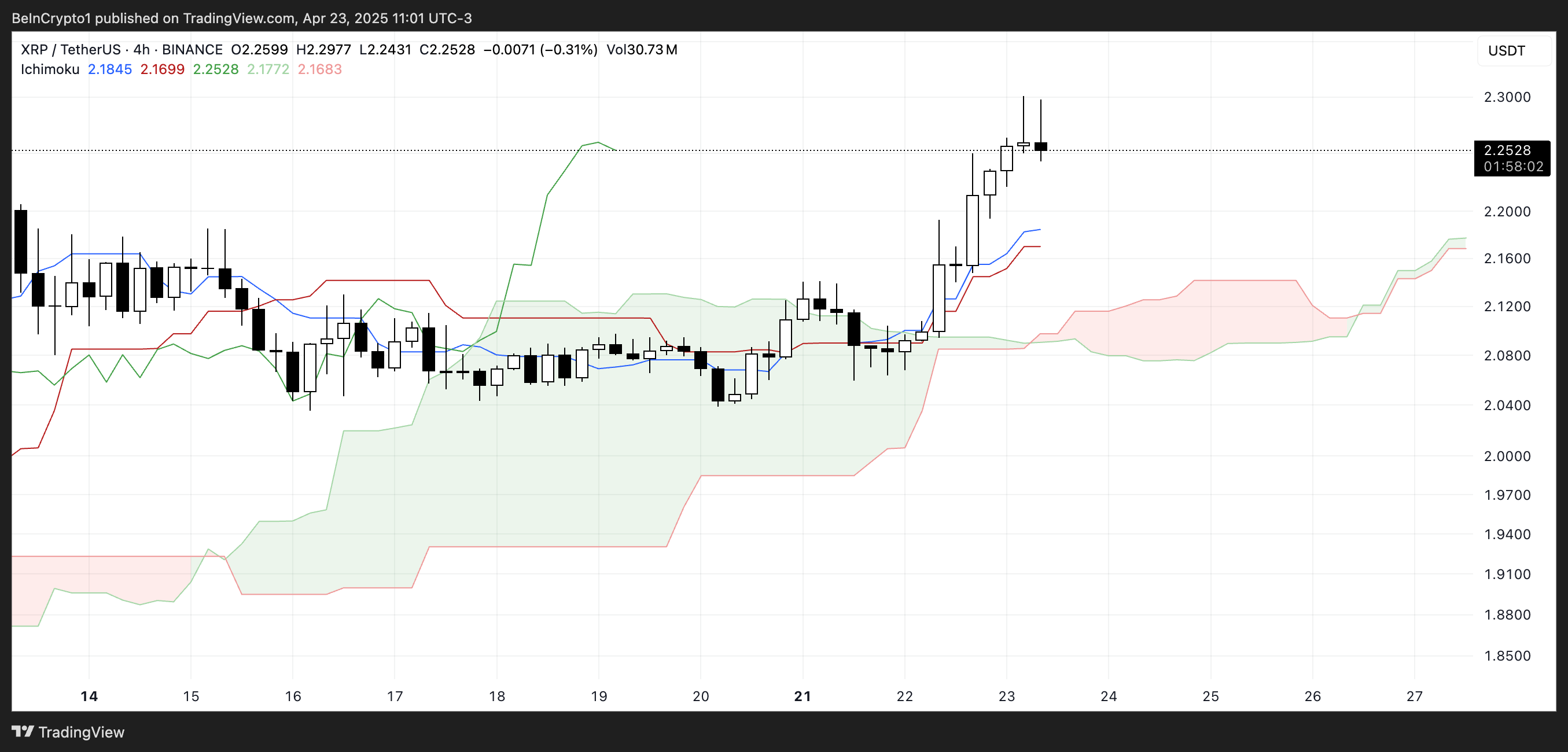

Ichimoku Signals Align for XRP as Cloud Turns Bullish

XRP’s Ichimoku Cloud remains in a bullish configuration, with the price clearly positioned above the Kumo (cloud), formed by the Senkou Span A (green line) and Senkou Span B (red line).

This indicates a continuation of upward momentum, though the green cloud ahead is narrower than before, suggesting that bullish conviction may not be as strong as in earlier phases of the trend.

Still, being above the cloud generally favors buyers in the short term.

The Tenkan-sen (blue line) is above the Kijun-sen (red line), signaling short-term bullish momentum through a positive crossover.

Meanwhile, the Chikou Span (green lagging line) is well above the cloud, confirming that current momentum is supported by past price strength.

However, the thinner cloud ahead calls for some caution — while the trend remains bullish, a weaker cloud can suggest reduced support if the price turns.

For now, XRP has a positive technical structure, but traders will monitor for any signs of weakness.

XRP Builds Momentum on Golden Crosses—Reversal or Rally?

XRP’s exponential moving average (EMA) lines have formed consecutive golden crosses since yesterday, a strong bullish signal that indicates growing upward momentum.

This pattern suggests that short-term averages are crossing above longer-term ones, often seen as a sign of a trend reversal or the beginning of a new uptrend.

If this momentum continues, XRP price could climb to test $2.50, with further resistance levels at $2.64, $2.74, and $2.83.

Should the broader bullish sentiment return, XRP may even attempt to reclaim the $2.99 level — and possibly break above $3 for the first time in months.

However, if the momentum fades and the trend reverses, XRP could pull back to test support at $2.18. A loss of that level would open the door for a deeper correction toward $2.03.

Continued downside pressure could push XRP below the $2 mark, with the next major support levels at $1.90 and $1.61.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.