2 Tokenized Gold Crypto Projects Saw Massive Growth Over the Last 15 Months – Altcoins Bitcoin News

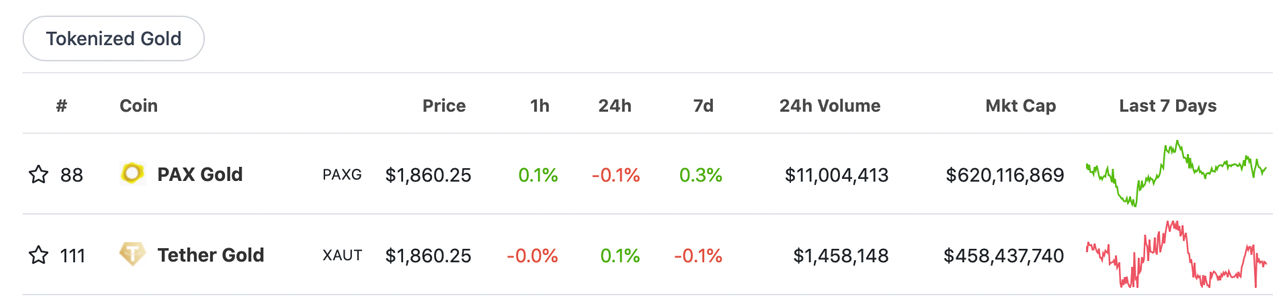

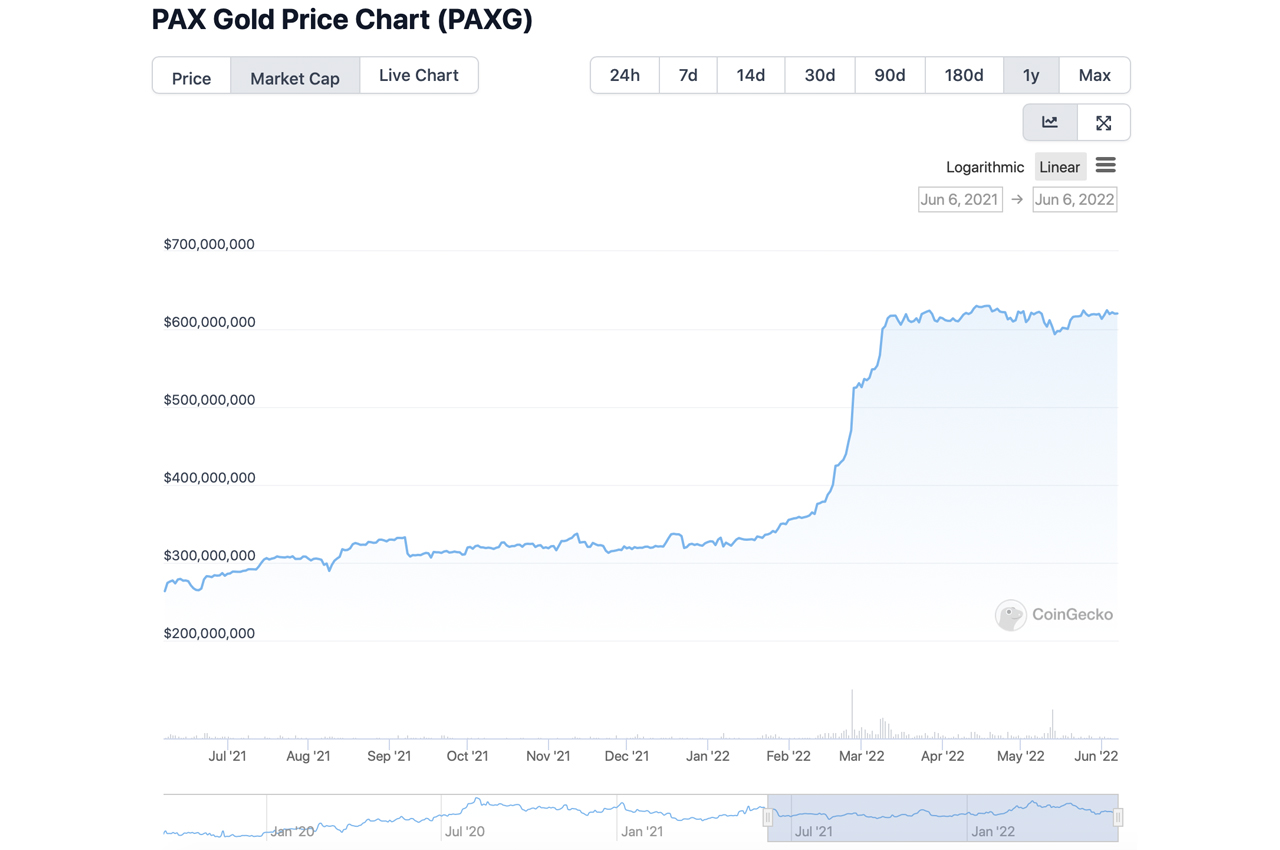

15 months ago the price of one ounce of fine gold was $1,790 per ounce and since then, it has increased in value 3.51% to today’s $1,853 per ounce exchange rate. While gold has risen in value, the top two tokenized gold coins have grown significantly since then. Pax gold (PAXG), for instance, has seen its market capitalization grow 407% since February 26, 2021, and Tether’s XAUT market valuation swelled by 248% since that day. Presently, PAXG’s and XAUT’s market capitalizations combined equate to just over $1 billion in value.

Pax Gold

Today, there’s just over $1 billion in tokenized gold coins between the top two gold token blockchain projects. The first project, with the largest market capitalization, is pax gold (PAXG) with its $620 billion valuation. The asset-backed coin called PAXG is an ERC20 token built on Ethereum and a single PAXG equates to one fine troy ounce (t oz) London Good Delivery gold (LBMA).

PAXG is issued by Paxos and owners can redeem PAXG “for LBMA-accredited Good Delivery gold bullion bars” with a minimum redemption amount of 1 t oz. Archive.org statistics indicate that PAXG was the second largest tokenized gold coin at the end of February 2021, with a $122 million market capitalization.

Today, PAXG holds the number one position in terms of tokenized gold coins by market capitalization and it has grown 407% during the last 15 months. The price of gold has only increased 3.51% since that day from $1,790 to $1,853 per t oz. This means most of PAXG’s growth stems from coins minted into circulation.

On February 26, 2021, PAXG’s valuation was only $122 billion and that day saw $16.9 million in 24 hour global trade volume. PAXG’s $620 billion valuation today saw $11 million in 24-hour global trade volume. PAXG’s most popular trading pair is tether (USDT) as the token captures 69% of all pax gold swaps.

The tokenized gold coin issued by Paxos has also seen 12.67% of all trades with the stablecoin BUSD, and bitcoin (BTC) is PAXG’s third most traded pair with 12.05% of all trades during the past 24 hours. Other notable PAXG pairs include WETH (3.09%), BNB (1.21%), USD (1.08%), and EUR (0.79%).

The top exchanges recording the most PAXG trading volume include Binance, Kucoin, Crypto.com, Binance USA, Gemini, Bybit, Bithumb Global, FTX and Coinex. While PAXG is now the top tokenized gold coin by market valuation, Tether’s XAUT is not too far behind.

Tether Gold

Everyone knows that Tether issues the stablecoin USDT and it’s widely known the stablecoin is the largest by market capitalization. However, its not commonly known that Tether issues other asset-backed coins that hold the redemption value for a few fiat currencies.

Tether also issues a token called tether gold (XAUT) and currently it is the second largest tokenized gold coin by market capitalization. At the time of writing, XAUT’s overall valuation is $458 million and it has seen $1.45 million in global trade volume during the past 24 hours. Tether’s XAUT website states that a single XAUT is equal to 1 t oz that meets LBMA standards.

Tether says it offers “multiple redemption options” and notes that “holders of XAUT can make a redemption request in the form of physical gold so long as holders have completed TG Commodities Limited’s verification process and hold the required minimum number of XAUT.”

On February 26, 2021, Tether’s tokenized gold coin XAUT had a market valuation of around $131 million and 24-hour global trade volume that day was $1.6 million. Since then, XAUT’s market valuation grew by 248% to today’s $458 million market cap.

PAXG and XAUT Have a Combined Value of $1 Billion

There are a few more asset-backed tokens that leverage the values and backing of precious metals held in vaults, but PAXG’s and XAUT’s market caps are giants in comparison. The two of them combined are valued at just over $1 billion based on the number of coins issued and the current value of gold.

According to data, there are 333,601 PAXG tokens in circulation today and 246,524 XAUT. In terms of gold’s overall market valuation of $11.795 trillion, PAXG’s and XAUT’s market caps are specks of sand in comparison. Among the crypto economy’s 13,400+ cryptocurrencies, PAXG’s valuation is ranked 86, while XAUT’s market cap is ranked 112.

What do you think about the top gold tokens capturing a market valuation of just over $1 billion and the growth they have seen in 15 months? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.