Has Ethereum Price Prediction to $6,000 Become Unrealistic?

For much of the past year, predictions were rife that Ethereum’s (ETH) price could reach five-digits. However, as Bitcoin (BTC) surged in 2024 while ETH lagged behind, market analysts have reassessed their forecasts.

With ETH struggling to keep pace, expectations for a $6,000 price tag have now been tempered, and indicators show that it might be time to lower expectations this cycle.

Investors Favor Bitcoin Over Ethereum

In August, the Pi Cycle Top revealed that Ethereum’s price could surpass $6,000 before the end of this bull market. Since then, several factors have shifted, making the initial prediction less attainable.

The Pi Cycle Top has historically been a reliable indicator of the highest price a cryptocurrency can reach within a specific period. It uses the 111-day Simple Moving Average (SMA) and the 350-day SMA to forecast this peak.

Currently, Ethereum’s price is at $2,603, but the 350-day SMA (purple line), which signals potential peak value, is now at $5,699. This suggests that ETH might struggle to surpass this price region in the near term, making further significant price increases more challenging.

Read more: How to Invest in Ethereum ETFs

This decline in Ethereum’s potential price increase could be linked to dwindling investor interest in the asset, especially when compared to Bitcoin.

For instance, Bitcoin ETFs have seen $1 billion in inflows within just three days this week, signaling strong institutional interest. In contrast, Ethereum ETFs only garnered $5 million on October 17, highlighting that institutional investors are favoring Bitcoin over Ethereum.

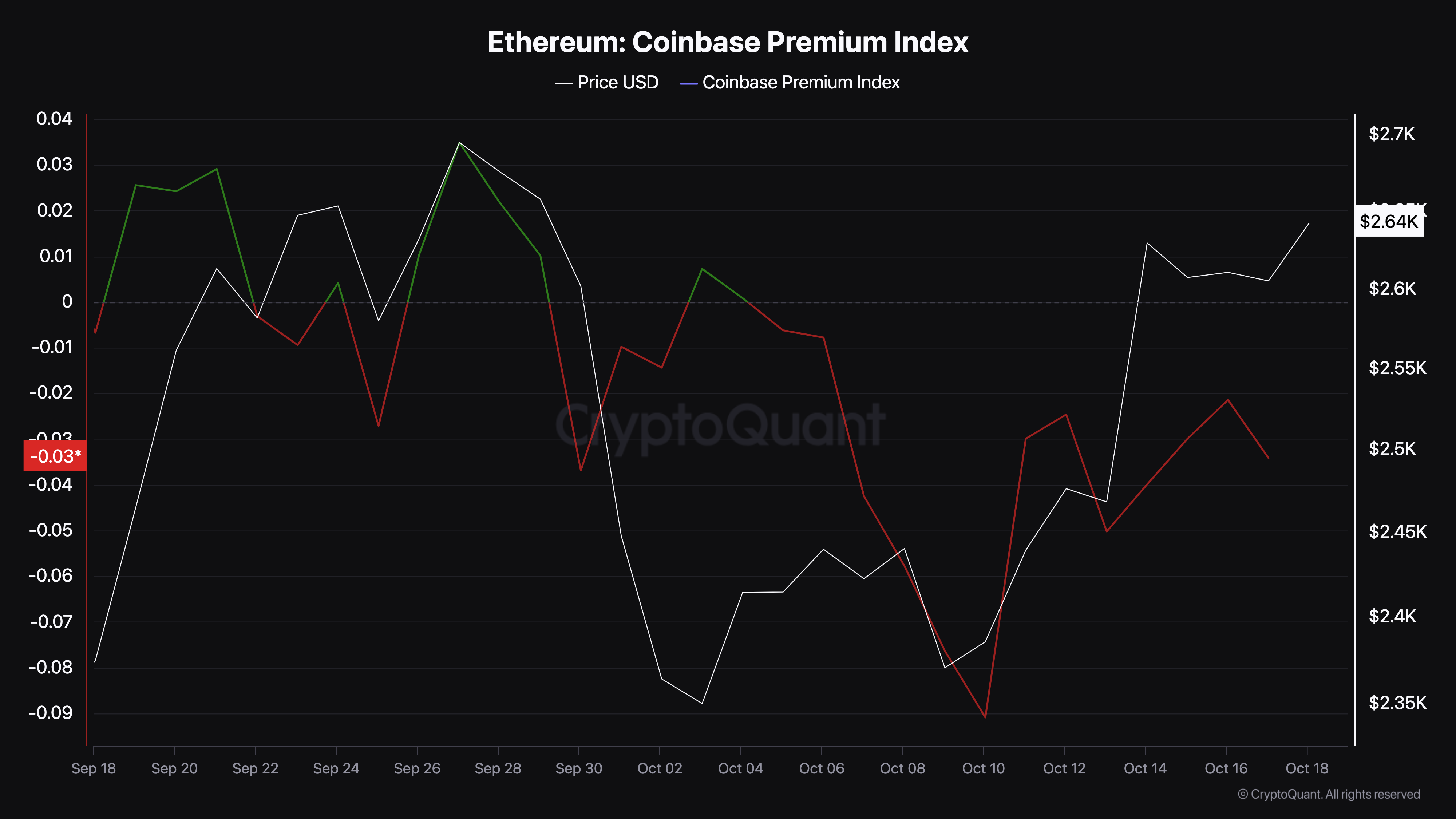

Moreover, this sentiment seems to have extended to retail investors in the US. According to CryptoQuant, the Coinbase Premium Index, which tracks buying and selling pressure, has recently dropped into the negative region. This shift indicates that more investors are selling ETH rather than buying, reflecting a bearish outlook for the altcoin.

ETH Price Prediction: Retracement Still Looms

Ethereum currently trades in a similar pattern to the price action in May and November 2021. On the weekly chart, whenever this happens, ETH’s price falls by double-digits. For example, in May of the mentioned year, the altcoin dropped by 52%.

With a similar technical setup, it declined by 45% by November. Currently, ETH has been banking on the $2,455 support to prevent such an occurrence again. However, the low trading volume suggests that the cryptocurrency might fail to hold the support for long.

Read more: How to Buy Ethereum (ETH) With a Credit Card: Complete Guide

If that happens, then ETH’s price could decrease to $2,186. On the flip side, if investors’ interest in Ethereum picks up, this prediction might not come true. Instead, ETH could jump to $3,814 in the mid to long-term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.